The Commercial and Finance Node recognises that the Commercial and Finance Function establishes accounting rules & reporting, supports investment & risk evaluation, assists with Advisory/business partnering and services (purchasing, contracts etc) and provides monitoring support (via spending information and revenue KPIs) into portfolios, programmes and projects pre delivery, during delivery and post delivery.

Finance professionals are needed throughout portfolio, programme and project lifecycles as integrated team resources, and providers of services that the Commercial and Finance Management team allocate and manage.

Whether Commercial and Finance support is provided out of a central function, or from a distributed hub and spoke model, the Commercial Finance function can be considered a Management Team. As such it has Objectives and Targets, and it must manage deployment of people across competing priorities for services, secondments or projects. As a Management Team, it has a governance agenda which includes resources and benefits. However, whereas for other Management Teams, the quality management and service details are of no interest within BIG, the Commercial and Finance services provided to the organisation are central to BIG.

Some of the reporting services are provided on a periodic basis, for example many organisations have an end of month process to process invoices, make payments, and recognise revenue.

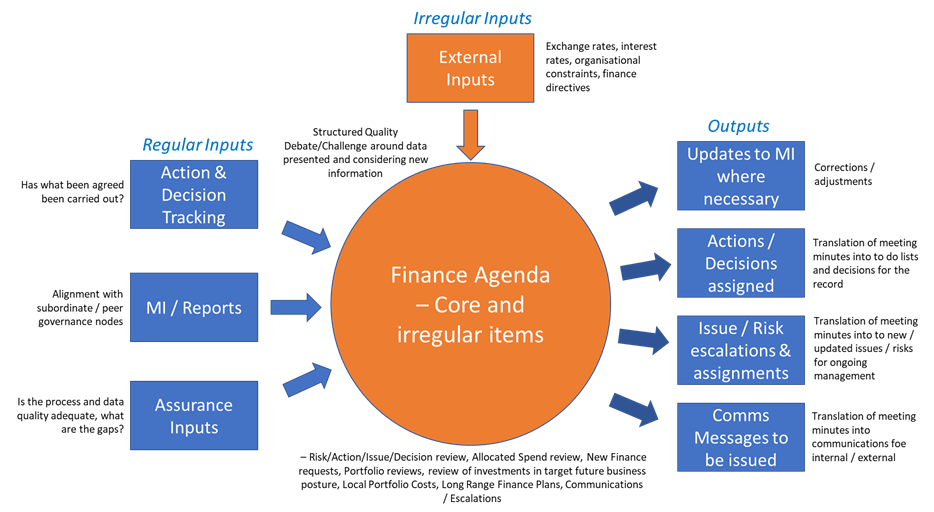

Assuming (for example) portfolios programmes and projects operate at least the performance the review elements of their governance nodes on a monthly basis, agendas are scheduled to fit with support, assurance processes and finance processes. The P3 community expects to support the Commercial and Finance Function in delivering and receiving a quality service which is achieved by operating the Commercial and Finance Agenda related to all P3M entities and governance nodes (or a subset):

Progress and Status

• Risk, Action, Issue, Decision review. What is the progress on matters actioned/decided last time?

• Allocated Spend review. Are all Governance Nodes spending in line with priority/allocation? What are the issues/actions?

• New Finance requests. What are the issues/actions?

Prediction

• Are the portfolios planning to spend within allocation? Is benefit/revenue/margin performance as expected (especially for product portfolios)? What is the forecast for financial KPIs? What are the issues/actions?

• Long Range Finance Plans – are there other Strategic initiatives on the horizon for which Finance will need to be prepared to provision for (e.g. merger, acquisition, disposal). In the context of the review – what are the issues/actions?

Enablers

• Process/data assurance – to confirm the management information is reliable • Local Portfolio Costs – are there any unexpected operational costs to accommodate?

• Communications/Escalations – Which matters have arisen that need escalation with which area?

Depending on the size of the portfolios, the Commercial and Finance review is one or many sub reviews. Each agenda is broken down into sections, wherein topics are listed, described and purpose and content definitions. Outputs are primarily risk/issue updates, actions (for example escalation to Main Board, Portfolio, Product or Operations Groups) and decisions.

Further information is available within the Core P3M Data Club including example management information examples to support the Commercial and Finance agendas. Further work is expected to share implementation stories, capture further MI examples, and develop agenda for specific Operational and Product Portfolio management application.

Link to content here:

Commercial and Finance ‘Governance Agenda’